Caverta

"Purchase 50mg caverta otc, erectile dysfunction scrotum pump".

By: Z. Benito, M.A., Ph.D.

Associate Professor, Yale School of Medicine

Deliberately investing at a loss-or even at subpar returns-is not a realistic business model erectile dysfunction treatment bangkok buy caverta 100mg line, despite the long-term erectile dysfunction age 60 order discount caverta on line, widespread societal benefits they may have impotence vs erectile dysfunction generic caverta 100 mg with visa. The use of guarantees can help attract private investment in biodiversity conservation by improving the risk-return profiles of conservation projects erectile dysfunction viagra buy cheap caverta 50mg. Guarantees offer several advantages for the public sector, by (i) bridging the gap between perceived and actual risk (guarantees are only disbursed in event of payment default); (ii) allowing for capital efficiency for issuing public institutions. Insurance products can also be used to hedge for liability for damage caused by the insured to a third party or resulting in biodiversity loss. In addition to providing contingent resources for immediate remedial action in the event of an environmental disaster, insurance can prevent future expenditures and thus reduce financial risks. Extending such insurance products to natural ecosystems, such as coral reefs and mangroves, is only recently emerging. Reefs and mangroves are of critical importance for coastal protection and disaster risk management. In agreement with local hotel groups, insurance premiums will be financed through an existing tax paid by hotel group owners of coastal properties. An independent Coastal Zone Management Trust was established for the administration of the funding to protect the reef during normal conditions and to pay for the insurance premiums that will cover the reef against hurricane potential damages. In addition, insurance and reinsurance companies can directly invest in biodiversity conservation to lower future costs and risks related to severe financial losses from environmental loss or disaster events, or they can insure actual natural assets. In cases where private insurance companies offer insurance for high-probability high risk events, national governments might provide financial guarantees to these companies to ensure that they will support them in paying debt obligations should the size of the event be significant. Guarantees in this context enable an entity to take on risk that either may be large or hard to predict, resulting in great uncertainties surrounding future costs. In certain instances, doing so may not be possible without government policies that commoditize the underlying benefits from nature and create environmental markets. For investment opportunities to exist, government policies that directly or indirectly facilitate the monetization of biodiversity benefits must be in place. The presence of ascertainable, quantifiable future cash flows or avoided future costs can strengthen the use case of biodiversity-related green financial products. Generating these cash flows may require strong regulatory enforcement mechanisms, rule of law and property rights, and long-term legal and political stability. Once the appropriate enabling conditions are in place, the funding and repayment schedule of green debt and equity products can be aligned to meet the needs of many biodiversity conservation projects. Examples of this are public fees and charges for public-private natural infrastructure services payments, forest carbon markets credit trading, and biodiversity mitigation requirements and offset payments. Private capital and the use of the financial products described in this section will also benefit from regulatory frameworks that support and incentivize their large-scale deployment in biodiversity conservation projects. Doing so would involve introducing regulation that supports financial institutions that mainstream biodiversity financing, through direct or indirect investments in conservation projects, or government provision of incentives for businesses and financial institutions that support biodiversity mainstreaming. The United States, for example, could leverage its experience in creating opportunities for financial institutions and economic development corporations to lend to small businesses and 148 civil society organizations in, and otherwise financially support the development of, low- and moderate-income communities. Despite the accelerating interest in private investment in conservation, biodiversity, as an investment opportunity, is behind other forms of environmental and social investing and is far from reaching its potential. Overcoming these shortfalls in metrics and guidance can potentially convince investors to redirect their investments into effective biodiversity initiatives. Notwithstanding these difficulties, efforts to address this gap are currently underway, with multiple standards and methodologies being developed to measure the biodiversity impacts of investments and provide clarity to the market. Metrics to compare biodiversity investments are elusive, as positive biodiversity impacts may vary from investment to investment, between geographies, and may have different time-lags until benefits are realized. Additionally, investor concerns about "greenwashing" and unsupported claims of environmental benefits may further deter capital flow to biodiversity projects. The financial and technical resources to underwrite the structuring of deals and designing viable projects are key to scaling up green finance for biodiversity conservation. The transaction costs associated with structuring green finance deals can be prohibitive, especially if the projects are of small size or the deals are innovative, highly structured, or multijurisdictional. The availability of investment blueprints, standardized contracts, and projects, and a support system of financial and legal institutions capable of working with biodiversity conservation projects, are critical to the execution of green financial transactions focused in biodiversity conservation.

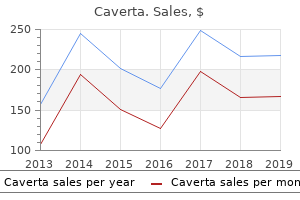

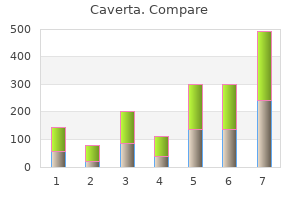

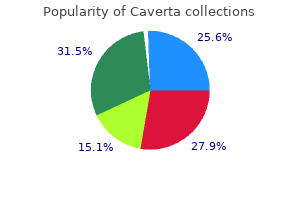

Relative to the overall size and scale of the working compliance markets in the world erectile dysfunction treatment after prostatectomy generic 50mg caverta otc, the voluntary market is much smaller in terms of overall volume of greenhouse gas emission reductions or carbon offsets produced erectile dysfunction doctors in richmond va quality caverta 50mg, including forest carbon offsets incidence of erectile dysfunction with age purchase caverta without a prescription. Nonetheless erectile dysfunction premature ejaculation treatment purchase 50 mg caverta free shipping, voluntary carbon projects exist in 83 countries around the world, and many of these are forest or land use carbon projects. Only a small subset of existing compliance markets allows offsets to be used that are generated from forest or land use projects. Early carbon markets did not allow, or placed heavy restrictions on, the use of forestry and land use offsets. At the time, there was uncertainty over how to address unique challenges posed by these projects, such as how to ensure permanence and minimize the risk of leakage. However, innovations from voluntary markets are being transferred to new compliance markets including new carbon accounting methodologies for a greater number of forestry practices, for agricultural practices, and for protection of key carbon-sequestering natural systems including peat lands, grasslands, mangrove forests, and coastal wetlands. As such, both voluntary and compliance markets are likely to play an expanding role in the protection of forests and biodiversity in the coming years. Additionally, the voluntary markets have served as the proving ground for other technical innovations that are being taken up by new and emerging compliance markets. While the program currently only applies to one industrial sector (power) and does not allow offsetting from any practices including forest or other land uses, over the next several years the program will scale up to cover as many as 7,000 companies in eight industrial sectors (power, petrochemicals, chemicals, building materials, iron and steel, nonferrous metals, paper production, and aviation). Although energy and industrial processes dominated these methodologies, four of the 200 under development are for forest carbon (two for forests and two for bamboo) and several others under development are targeted to changing agricultural practices and protection of grasslands, coastal wetlands, mangroves, park systems, endangered species, and urban ecosystem restoration. Countries can create their own methodologies for producing and utilizing forest carbon offsets, but another option is for countries to allow the use of currently existing voluntary offset methodologies that have been developed and tested for forest or other land use carbon offsets. Climate Policies There is a clear case for climate policies to address and provide tangible benefits to the protection of biodiversity. Deforestation, land degradation, coastal ecosystem degradation, and other land use changes contribute to both higher emissions and declining biodiversity. The co-benefits associated with forest carbon projects can include protecting watershed areas that supply clean water, safeguarding critical habitat for biodiversity, and even providing important social benefits such as the health and welfare improvements associated with using clean cookstoves and biofuels for cooking. Mangroves and seagrass ecosystems, while sequestering carbon, also provide important havens for marine biodiversity as well as contribute to disaster risk reduction. As new compliance programs come online, and as these programs expand to allow forest and other land use-based offsets, it will become increasingly important to ensure that metrics for evaluating biodiversity impacts are included. In determining approximate levels of current and future spending on carbon programs that have discernible benefits to these activities include biochar, conservation agriculture, animal management, improved feed, and improved rice cultivation. Voluntary markets that incorporate forest and other land use project for offsets 2. Cap-and-trade programs and other compliance markets that incorporate forest and other land use project for offsets or allowances 3. National carbon tax programs that put a price on carbon and, with offsets, additionally incorporate provisions for protection of forests or other ecosystems 4. Current State the current state of the nature-based solutions and carbon market expenditures is summarized in Table 5. See Appendix A for detailed information on the calculations behind the current carbon market investments. Future State this report estimates that nature-based solutions and carbon markets in 2030 will fall in the ranges in Table 5. The Compound Annual Growth Rates were calculated using historic growth rates of these markets, and more information can be found in the Methodology annex. Thus, the amounts listed here are initial estimates that could benefit from future studies. Although private investment in forest and land use carbon is still a relatively small component of the total capital invested in conservation-oriented projects, it is growing annually and likely to play a larger and more important role in the future. For these countries, lack of technical expertise, tools, and/or capacity can be a challenge. There are also political challenges that are unique to forestry and agricultural sectors. Currently, only one country regulates emissions from the forestry sector (New Zealand) and no country regulates emissions from agriculture. Often the acutely poor rely on forestry or agriculture for their livelihoods, so regulating these sectors may require addressing the economic impacts and losses of reducing forest use and changing agricultural practices.

In 1996 impotence causes and cures buy caverta 50mg lowest price, Indian farmers ransacked a Kentucky Fried Chicken restaurant in Bangalore 60784 impotence of organic origin order caverta uk, convinced that the chain threatened their traditional agricultural practices erectile dysfunction 35 order generic caverta canada. He has written a French bestseller entitled the World Is Not for Sale - And Nor Am I! Farmers erectile dysfunction causes natural treatment buy cheap caverta 100mg on line, leftists, anarchists, nationalists, environmentalists, consumer advocates, educators, health officials, labor unions, and defenders of animal rights have found common ground in a campaign against the perceived Americanization of the world. Fast food has become a target because it is so ubiquitous and because it threatens a fundamental aspect of national identity: how, where, and what people choose to eat. The longest-running and most systematic assault on fast food overseas has been waged by a pair of British activists affiliated with London Greenpeace. The loosely organized group was formed in 1971 to oppose French nuclear weapon tests in the South Seas. It later staged demonstrations in support of animal rights and British trade unions. They ran the organization without any formal leadership, even refusing to join the International Greenpeace movement. A typical meeting of London Greenpeace attracted anywhere from three people to three dozen. Along the top of the leaflet ran a series of golden arches punctuated by slogans like "McDollars, McGreedy, McCancer, McMurder, McProfits, McGarbage. The libel laws in Great Britain are far more unfavorable to a defendant than those in the United States. Under American law, an accuser must prove that the allegations at the heart of a libel case are not only false and defamatory, but also have been recklessly, negligently, or deliberately spread. Moreover, the defendant in a British court has to use primary sources, such as firsthand witnesses and official documents, to prove the accuracy of a published statement. Secondary sources, including peer-reviewed articles in scientific journals, are deemed inadmissible as evidence. Dave Morris was a thirty-six-year-old single father, a former postal worker interested in labor issues and the power of multinational corporations. Steel had left school at seventeen, Morris at eighteen; and neither could afford a lawyer. Morris and Steel were denied legal aid and forced to defend themselves in front of a judge, instead of a jury. The burden on the defendants was enormous: Morris and Steel had to assemble witnesses and official documents to support the broad assertions in the leaflet. The pair proved to be indefatigable researchers, aided by the McLibel Support Campaign, an international network of activists. By the end of the trial, the court record included 40,000 pages of documents and witness statements, as well as 18,000 pages of transcripts. The British media seized upon the David-and-Goliath aspects of the story and made the trial front-page news. After years of legal wrangling, the McLibel trial formally began in March of 1994. It ended more than three years later, when Justice Rodger Bell submitted an 800-page Judgement. The judge ruled that the two had failed to prove most of their allegations - but had indeed proved some. Many of its labor, food safety, and advertising practices had already been publicly criticized in the United States for years. The spying had begun in 1989 and did not end until 1991, nearly a year after the libel suit had been filed. During some London Greenpeace meetings, about half the people in attendance were corporate spies. One spy broke into the London Greenpeace office, took photographs, and stole documents.

Subsequently erectile dysfunction age 25 proven caverta 100mg, regional gross agricultural production value per ha is calculated as a proxy for farmer income per area erectile dysfunction 55 years old cheap 100 mg caverta with mastercard. Estimates of global area of agricultural croplands and percentages of croplands under sustainable agriculture practices were obtained from Kassam et al erectile dysfunction treatment psychological causes discount caverta 50mg with amex. It is assumed that costs to transition to sustainable rangeland practices are incurred as upfront restorative investments over the initial two years erectile dysfunction surgery options generic caverta 50 mg without a prescription, whereby longerterm sustainable grazing siting and rotation practices are maintained but without significant net increase in costs,766 using a 2050 time horizon to transition all rangeland, degraded and otherwise, to sustainable grazing practices, amortizing equally across years to generate an annual incremental area of degraded area to be transitioned. We assume that sustainable forestry practices maintain these ecosystem services in perpetuity, and thereby must implement forest management practices that balance harvest and planting practices with soil health, water management, and biodiversity protection to maintain ecosystem integrity. To generate the annual cost of sustainable forest management, we first calculated the global forest area using World Bank data at the country level. Sustainable fisheries management is characterized by precautionary harvest that recognizes ecosystem-level impacts of fishing and protects long-term natural capital, enforcement of fisheries management practices, and secure fishing rights. To estimate a global annual need for sustainable fisheries management, thereby balancing food production with biodiversity conservation, we utilized estimates for global sustainable fisheries management costs from Mangin et al. Below, we assess the financial needs to restore mangrove, saltmarsh, and seagrass coastal ecosystems globally. Our approach is to estimate a baseline restoration area target, estimate a per unit area restoration cost, and then estimate total annual costs amortized to achieve restoration to target baseline by a time horizon of 2050. Animal-dominated oyster and coral reef systems also provide vital ecosystem services supporting high biodiversity and coastal resilience. For example, oyster reefs filter pollutants from massive volumes of water, and coral reefs harbor global marine biodiversity hotspots. Both systems also produce hard structure that dissipates storm 212 and wave energy. As with plant-dominated coastal ecosystems, reductions in coastal runoff and city-borne pollution, and long-term climate warming mitigation, will be important for conserving and restoring these systems. However, whereas for the plant-based critical coastal ecosystems, restoration activities can be effective with direct and large-scale plantings, animal-based reef systems are more complex and direct restoration efforts have proved difficult. Presently, coral reef restoration methods that can scale have not yet been proven and can be of high cost. Thus, lacking viable restoration options, we did not include an estimate of direct coral reef restoration costs; however, we stress the importance of continued research and development to advance coral reef restoration tools. Similarly, oyster reef restoration has had mixed success, particularly when runoff and pollution stressors persist. Mangroves Global records for mangrove distribution are not available prior to 1980. While there is debate about the level of mangrove degradation prior to 1980, evidence suggests consistent loss of mangroves over the past 40 years. Using values for current mangrove distribution generated from remote sensing data (73,624 km2 to 152,607 km2; year 2000 values reported in Casey and Hamilton and Casey, 2016, and decayed to 2019 values using 0. Subsequently, we coupled the restoration area targets with per unit area estimates of mangrove restoration. Seagrasses Global contemporary and historical estimates of seagrass distribution are available, with the most recent values generated in 2009 at 177,000 km2 and representing an estimated 51,000 km2 of seagrass beds lost since a historical baseline value of 1879. Therefore, based on a historical baseline of 1879 we estimate the total area of seagrass to be restored is 52,100 km2 or 173,667 ha per year to achieve global restoration by 2050. Effective invasive species management requires resources for proactive efforts to prevent introduction of species, monitoring to detect species introductions as well as assess the state of extant introductions, control efforts to contain or eradicate invasions, and mitigation efforts to restore damaged systems. Empirical analyses have demonstrated that shipping for trade represents the dominant transport vector of invasive species globally. We assume the habitat footprint of cities can be accommodated through the biodiversity conservation target of preserving 30% of the surface of the earth in protected areas.

Order caverta mastercard. 4 Causes of Erectile Dysfunction and What Cures ED.